Address

Unité nationale d'Eurydice

ANEFORE ASBL

eduPôle Walferdange

Bâtiment 03 - étage 01

Route de Diekirch

L-7220 Walferdange

Tel: +352 247 85289

E-Mail:info@anefore.lu

Website: www.anefore.lu

Funding

Funding of early childhood education and care

Since the entry into force of the law of 1 August 2018 on 'mini-crèches', the Luxembourg State participates in ECEC structures through the system of ECEC service vouchers (CSA; chèque-service accueil).

This system allows parents to benefit, depending on their income, from reduced rates or even free hours of care in childcare facilities. The ECEC service voucher thus contributes to better equal opportunities. It facilitates all children's access to quality supervision, whatever structure they may attend.

The ECEC service voucher is intended for all children aged from 0 to 12 years (or even more if still attending elementary education), whose parents reside in Luxembourg or at least one of whose non-resident parents works in Luxembourg and is a citizen of the European Union.

With the ECEC service voucher, parents can benefit from reduced rates in crèches, relay houses, homes and with parental assistants, provided however that the reception structure is recognized by the Ministry of Education, Childhood and Youth. To obtain the agreement, the ECEC structure must meet certain well-defined quality requirements, including that of fulfilling a public service mission.

The Ministry of National Education, Childhood and Youth is responsible for granting accreditation to the structure. Accreditation is a guarantee of educational quality, since the structure must commit to implementing the national reference framework on non-formal education for children and young people.

The prices applicable vary depending on the household income and the number of children. The offer may also be free.

Funding of pre-primary and primary education

Main policy goals of public funding

Public and private elementary education (pre-primary and primary) aims at gradually developing pupils':

- Knowledge of foreign languages, mathematics and science

- Intellectual, emotional and social aptitudes, as well as capacity for judgement

- Awareness of time and space, as well as understanding and respect for the world around them, by observation and experimentation

- Motor skills, athletic and physical abilities

- Manual, creative and artistic skills

- Citizenship, sense of responsibility and respect for others.

The objective is to make learners fit to continue their education pathway and keep learning throughout all their life.

Types of funding and bodies involved

The municipalities bear the costs of public elementary schools' infrastructures and equipment. The amounts required are part of the municipal yearly budgets.

The State contributes to these expenses with its yearly budget.

As to the teaching provision, an allotted share of lessons is allocated by the State to the municipalities. The quota of these lessons is determined by a framework based on socio-economic indicators.

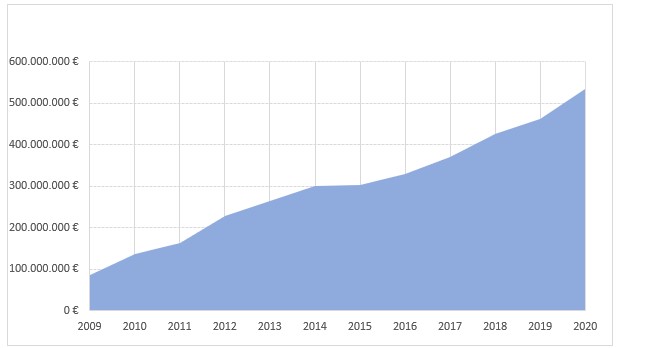

The State bears the school personnel's salaries, except for lessons or services that exceed the abovementioned quota (modified grand-ducal regulation of 18 February 2010). In addition, the budget for education and care service (service d'éducation et d'accueil - SEA) has been steadily increasing each year.

(Source: Education report 2021 - Factsheet N°2. (PDF), p. 39, data extracted on 24/01/2022)

Funding of secondary education

Main policy goals of public funding

The mission of secondary schools is to ensure school instruction and, in addition to the families’ activities, to educate pupils according to the laws and regulations on secondary education. School education aims at guiding pupils towards a recognised certification, at allowing them to acquire general knowledge and at preparing them for working life as well as for their responsibilities as citizens and as human beings. Pupils are supported in their personal development and orientation.

Types of funding and bodies involved

Secondary schools operate under the direct authority of the Ministry of Education, Children and Youth (MENJE; ministère de l’Éducation nationale, de l'Enfance et de la Jeunesse). They are considered as 'separately-managed' State bodies, which means that they manage their financial resources in a relatively autonomous way.

The State subsidy is allocated on the basis of a budget plan set up by the principal of each secondary school. The repartition of the allocated amount has to be approved by the school’s education council.

Financial autonomy and control

Pre-primary and primary education

The staff costs of pre-primary and primary schools (elementary schools) are directly taken in charge by the State. Elementary school teachers' work is paid by the State to each school up to the allotted share of lessons allocated. Municipalities pay the costs of infrastructure and equipment.

As a result of this repartition, the costs of elementary education are monitored through the budgets of the State and the municipalities.

Secondary education

Secondary schools are submitted to the clauses concerning separately-managed State bodies.

Their resources comprise:

- A State subsidy approved for a certain contingent of school lessons

- The balance carried over from the previous year

- Income from services provided or other operating revenues

- Donations and legacies.

Regarding educational quality and results, secondary schools are monitored by the means of the secondary school report (rapport-lycée), which is set up by the Agency for quality (see Eurydice article 11.1 Quality Assurance).

As for the State subsidy they have received, secondary schools have to report to the service for secondary education on how and to what end the allocated lessons have been used. Their financial accounts are submitted to the Ministry of Education, where they are controlled by the financial service. The accounts are then transferred to the financial control of the Ministry of Finance, which is in charge of controlling the commitment and authorisation of all State expenditure.

Statistics on the 2020/21 are available in the Ministry of Education's publication Key figures of national education. They include information on the school system's budget (in French and English).

Fees within public education

Public education is free of cost and funded by the State budget, where it is the highest budgetary entry. Pupils and their parents don't contribute to the schools’ operating costs.

Financial support for learners' families

Several measures are designed to support families to the benefit of children. Financial support is described on the website of the Ministry of Family Affairs, Integration and the Greater Region, in French and German.

The Citizen portal provides further information in English.

Family allowance

The family allowance is a cash benefit allocated to persons in charge of children in compensation of education-related expenses.

Every child legally resident, and living continuously and effectively in Luxembourg, receives a monthly allowance from their month of birth until the age of 18 years.

This age limit may be extended up to 25 years of age for:

- A child pursuing full time secondary studies (a minimum of 24 h/week, evening classes and distance learning excepted)

- A pupil of an institution or education centre for Special Needs in Luxembourg or abroad

- An apprentice in vocational education and training whose compensation is lower than the minimum social wage.

Students pursuing higher education are not eligible for family allowance.

A child raised abroad is also entitled to receive family allowance, if at least one of the parents is working in Luxembourg. The amount may vary depending on allowances already perceived in the country of residence.

A child who is a family member of a person working abroad, while insured under Luxembourgish legislation, can also be entitled to family allowance according to the country of employment, provided European regulations apply in that country, or else a bilateral or multilateral agreement with Luxembourg.

The family allowance is managed by the Children's Future Fund (CAE; Caisse pour l'avenir des enfants), previously called National Family Allowance Fund (CNPF).

The benefit is the same for each child: € 271.66 per month. (Note: The indexation of the amount of the family allowance with retroactive effect to 1 October 2021 came into force on 1 January 2022).

This amount is supplemented, per child, by:

- € 20.53 from the child’s age of 6 years

- € 51.25 from 12 years on.

Transitional arrangement

For children who already benefitted from the former family allowance before the entry into force of the Act of 23 July 2016, the amount paid will continue to be scaled according to the number of children in the family.

Allowance for the beginning of the school year

Pupils over six years residing in Luxembourg and benefitting from the family allowance are automatically granted a yearly one-time allowance for the beginning of the school year (back-to-school allowance), paid in August. The amount varies with the age of the child:

- € 115 from 6 to 11 years

- € 235 from the age of 12 years.

This financial support is intended to compensate for expenses incurred for school supplies at the beginning of the school year.

The payment of the allowance ceases as from the beginning of the calendar year where studies end.

Childcare-service vouchers for early childhood and non-formal education and care

The State-funded Childcare-service voucher (CSA; Chèque-Service Accueil) offers financial support to children and their families while providing more equitable access to child care. This voucher offers differentiated price reductions for accredited public and private day care services, parent assistance and further non-formal educational provision.

Membership of the CSA system is available free of charge to parents of all children living in Luxembourg who are either younger than 13 years or who are still attending elementary education. Families benefitting from the Guaranteed minimum wage or identified as being at risk of poverty qualify for a reduced financial contribution. The 4th child is entitled to care and service free of charge.

Tax advantages

The website of the 2017 tax reform informs (in French) about the Luxembourgish tax policy and its implementation.

Couples can chose to be taxed either separately or together.

Present-day regulations concerning the taxation (modération d'impôt) of parents with one or more dependent children are described on the website of the tax administration.

In some cases, alternative tax advantages for parents of dependent children are available:

- If no other tax reduction for children is applicable, taxpayers can apply for a tax deduction (modération d’impôt sous forme de dégrèvement fiscal) of their income tax. The deduction amounts up to € 922.5. Surplus amounts are not paid out.

- Single taxpayers with dependent children may demand a single-parent tax credit (crédit d’impôt monoparental). The yearly amount varies according to the taxpayer’s annual income:

- € 1 500 for an income below € 35 000

- A degressive amount between € 1 500 and € 750 applicable to yearly incomes between € 35 000 and € 105 000.

Support for secondary school students from low-income families

Students from low-income families enrolled in full-time secondary education in Luxembourg can obtain 2 types of support on social grounds:

- A yearly allowance (subvention pour ménage à faible revenu), the amount of which is determined by the social index, calculated on the basis of the net family income and the number of dependent children

- A € 100 flat-rate voucher for school supplies (forfait pour l’achat du matériel scolaire) (Règlement grand-ducal du 29 août 2017).

Support for secondary school students from low-income families (subvention pour ménage à faible revenu) is managed by the Centre for Educational Psychology and Guidance (CePAS; Centre psycho-social et d'accompagnement scolaires). The application downloaded from the CePAS website has to be submitted via the school’s psychology and guidance service SePAS (Service psycho-social et d'accompagnement scolaires).

Procedures, prerequisites and deadlines and are explained on the official website Guichet.lu.

Financial support for families of pupils with special educational needs

Additional special allowance

An additional special allowance (allocation spéciale supplémentaire) is awarded to children with a permanent physical or mental impairment of at least 50 % compared to a healthy child or adolescent of the same age. It amounts to € 200 per month and aims to compensate for additional expenses related to the impairment.

The additional special allowance is paid until the child’s age of 25 years, under condition that the impairment of at least 50 % persists and is certified by a physician.

Schooling provision

Children and young people with special educational needs (SEN) are included, as far as possible, in mainstream education. The inclusion of SEN pupils involves a wide range of areas, including:

- education and training (elementary and secondary, vocational training, higher education, music lessons, adult learning)

- education and childcare services (nurseries and childcare centres)

- activities for young people (youth centres, holiday and leisure activities).

The Ministry of Education, Children and Youth organises SEN monitoring on local, regional and national level. Since 2018, the Ministry includes competence centres for specialised educational psychology for the follow-up and support of SEN pupils (see Eurydice chapter 14 - National reforms in school education).

This public offer is free of charge. The State may also provide specific equipment, didactical and re-education material and organise the pupils' transport to and from school.

Financial support for learners

Financial support for learners in psycho-social distress

Adult students enrolled in full-time secondary education who have been forced to leave their family due to a situation of serious crisis can obtain a quarterly financial support. The situation of psycho-social distress has to be attested (i.e. divorce, blended families, violence, alcoholism, death, etc.) A social worker's report on the social and financial situation has to be submitted together with the questionnaire for this subsidy.

Financial support to help learners remain in education (subvention du maintien scolaire) for persons in psycho-social distress is managed by the CePAS (Centre psycho-social et d'accompagnement scolaires).

Other types of support

Free schoolbooks

At elementary school, books and other didactic material are provided free of charge by the municipality.

Since school year 2018/19, the mandatory schoolbooks in all types of secondary education applying national curricula are given free of charge to the students. If the students can obtain second-hand books, they are given a voucher of 50 % of the books’ value from the bookshop.

Free public transport

Since 1 March 2020, public transport in Luxembourg can be used free-of-charge througout the country and for all modes of transport - trams, trains and buses. The social measure applies to all users - residents, cross-border commuters or tourists.

Other social benefits

- Meals: Luxembourg’s school canteens are managed by the Ministry of Education's catering service Restopolis. Pupils' meals are subsidised and offered below market-prices

- Insurance: children eligible for family allowance may be co-insured with their parents’ insurance policy, if they are not covered in their own right.

Private education

Luxembourg offers alternative schools to public schools:

- Public schools applying the official curriculum of the Ministry of Education

- Public schools that do not apply the official curriculum of the Ministry of Education

- International schools.

Funding

Both private schools that apply and private schools that do not apply national curricula and syllabi receive State subsidies. They are however calculated in different ways. To this end, a contract with the State is established. The details of this contract as well as the calculation of State subsidies are defined by the modified law on the relations between the State and the private education system (loi modifiée du 13 juin 2003).

International schools not organised by the State have a different status and thy do not receive subsidies nor are they subjected to educational monitoring. European schools fall into a different category - the administration and the funding of an accredited European school are the responsibility of the school's host Member State.

Financial autonomy and accountability

Private schools receiving State subsidies are subjected to educational monitoring by national authorities. According to article 20 of the modified law of 13 June 2003, private education institutions that wish to obtain a contract with the State have to provide the State with all documents and information necessary to control their engagements, including balance sheets, bills and receipts.

Fees

Parents contribute to the private schools' costs. Fees may vary depending on the type of institution (see Eurydice article 6.10 Organisational variations and alternative structures).

Financial support for learners and their families

Pupils and their families benefit from the same types of support as pupils enrolled in public education.