Funding

Colleges of social work

Colleges are part of the school education system and are administered by the local government at the regional / province level. Thus, they are funded according to the rules set out for the types of educational institutions discussed in chapter Early childhood and school education funding.

Higher education institutions

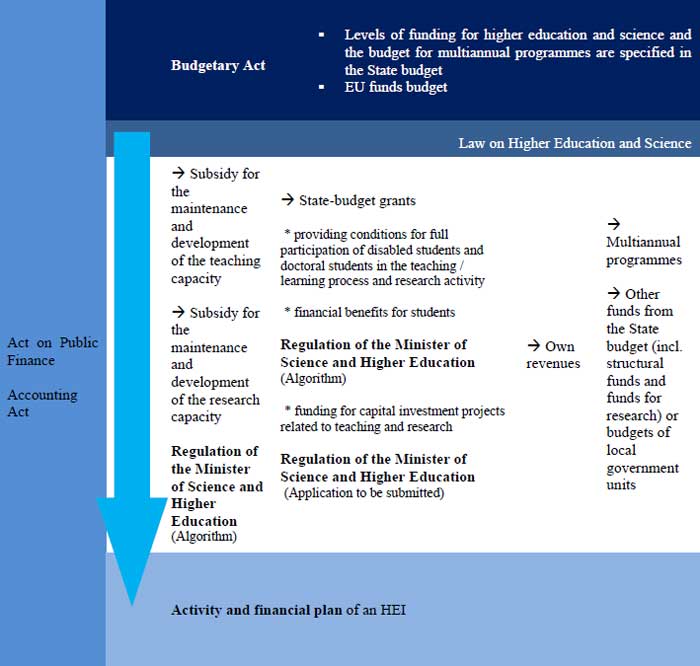

The Law on Higher Education and Science (ustawa – Prawo o szkolnictwie wyższym i nauce) sets a comprehensive framework for higher education funding, covering both teaching and research activities of higher education institutions (HEIs).

The State budget is the main source of funding for HEIs. Higher education funding is part of the section of the State budget managed by the minister responsible for higher education and the part ‘Higher education and science’ included in other sections of the State budget. The overall budget allocated for this purpose is set annually in the Budgetary Act.

Pursuant to the Law on Higher Education and Science, the level of State-budget funding for higher education and science allocated for a given financial year may not be lower than in the previous year. The amount earmarked in the State budget for higher education and science is also subject to annual indexation; it is adjusted at least by:

-

expenditure for science: the real GDP growth forecast multiplied by the indexation rate;

-

expenditure for higher education: the consumer price index planned in the State budget.

The indexation rate for science funding is 1.75 in 2024. Pursuant to the Law, the rate will increase by 0.1 per year until 2028.

In the next stage, the minister responsible for higher education and science distributes funds among HEIs. The level of funding depends primarily on the type of HEI (university-type or non-university, and public or non-public). The table below provides an overview of the funding arrangements: teaching-related objectives for which an HEI of a given type may receive funding; the type of funding provided; and the method of allocation.

|

|

Funding allocation mechanism |

Type of funding allocated |

Funding available to a given type of HEI |

|||

|

Public HEI |

Non-public HEI |

|||||

|

University-type |

Non-university |

University-type |

Non-university |

|||

|

Maintenance and development of the teaching capacity (e.g. training of students in full-time programmes; maintenance of student dormitories; professional development of staff) |

Algorithm |

Subsidy |

YES |

YES |

NO |

NO |

|

Maintenance and development of the research capacity (for the training provided in doctoral schools) |

Algorithm |

Subsidy |

YES |

NO |

YES |

NO |

|

Financial benefits for students (maintenance grants; grants for students with disabilities; aid payments; the Rector’s scholarships) |

Algorithm |

Targeted grant: specific-beneficiary grant |

YES |

YES |

YES |

YES |

|

Capital investment related to teaching |

Application |

Targeted grant: specific-purpose grant |

YES |

YES |

NO |

NO |

|

Tasks related to the provision of adequate conditions for full participation of disabled persons in the teaching / learning process and research activities |

Algorithm |

Targeted grant: specific- beneficiary grant |

YES |

YES |

YES |

YES |

The minister responsible for higher education and science lays down, by regulation, detailed arrangements for the allocation of funding to HEIs. However, the Law on Higher Education and Science defines the funding allocation criteria that the minister should take into consideration.

|

|

Funding allocation criteria applied in algorithms |

|

Maintenance and development of the teaching capacity (e.g. training of students in full-time programmes; maintenance of student dormitories; professional development of staff) |

Data concerning, in particular:

|

|

Maintenance and development of the research capacity (e.g. training provided in doctoral schools) |

Data concerning, in particular:

|

|

Financial benefits for students (maintenance grants; grants for students with disabilities; aid payments; the Rector’s scholarships) |

Data concerning, in particular:

|

|

Tasks related to the provision of adequate conditions for full participation of persons with disabilities in the teaching / learning process and research activities |

Data concerning, in particular:

|

Pursuant to the Law, where this is justified. the Minister may increase the amount of a subsidy or grant for the tasks related to financial benefits for students, taking into account the needs related to teaching and research activities (for example, the tasks of particularly high relevance to the national research policy; unforeseen circumstances; a higher number of students entitled to receive financial support). In such cases, the Minister is required to take into consideration the resources available in the budget, the type of the institution concerned, and the quality of education provided or of the research conducted.

The budget also includes an amount for the Minister’s scholarships and awards.

Furthermore, the State budget provides funding for some capital investment projects in HEIs within the framework of multiannual programmes.

Additionally, HEIs may receive other funds from the State budget (including the structural funds and funds for research) and from the budgets of local government units or their associations.

The higher education funding system in Poland:

Source: Author’s elaboration.

Subsidy for the maintenance and development of teaching and research capacities

The main part of the subsidy is divided into sections allocated to public university-type HEIs, public non-university HEIs and non-public university-type HEIs.

The level of the subsidy depends largely on the level of the subsidy granted in the previous year, which is expected to ensure financial stability of HEIs. This is achieved by applying the so-called transfer rate constant, which is 0.25 for public HEIs in 2025.

Furthermore, pursuant to the relevant Regulation of the minister responsible for higher education and science, the level of the subsidy calculated according to the algorithm and provided to public HEIs in 2024 may not be lower than 100% and higher than 106% of the amount granted in the previous year under comparable conditions.

Public university-type higher education institutions

The algorithm for the allocation of funding is based on the following 7 criteria:

-

Students:

-

the number of students in full-time programmes (first-, second- and long-cycle programmes);

-

cost indices of different fields of study; and

-

student to staff ratios (depending on the reference number of students and of doctoral students included here per academic teacher, which was 13 for a public university-type HEI in 2020).

-

-

Doctoral students: depending on the number of doctoral students in doctoral schools (which have operated since the academic year 2019/2020);

-

Staff:

-

the average number of academic staff (in full-time equivalents) multiplied by the relevant weightings depending on the position held by staff (2.5 for a Professor; 2 for a University Professor; 1.5 for an Assistant Professor); and

-

the number of non-Polish staff holding the title of Professor or the position of University Professor (but employed outside a given HEI) who taught classes at a given HEI for at least 60 hours in the previous year (weighting 3).

-

-

Internationalisation: the number of students and doctoral students participating in international student exchange.

-

Research activity:

-

the number of disciplines in which a given HEI has been awarded a research category higher than C (with the weightings depending on the category and ranging from 0.75 for Category B to 1.75 for Category A+);

-

cost indices of the disciplines concerned; and

-

the number of staff (in full-time equivalents) conducting research activities in the disciplines concerned.

-

-

Research and development (R&D): R&D internal expenditure incurred by a given HEI.

-

Projects: the number of national and international research projects implemented by a given HEI (with higher weightings for international projects, and, in particular, those funded under the Horizon 2020 and Horizon Europe Programmes, and projects where the HEI was involved as the only institution or was the lead partner of the consortium).

The criteria described above are used to allocate 75% of the subsidy.

Each criterion is assigned a weighting as presented in the table below (values for the year 2024):

|

Component |

Public university-type HEIs |

|

Students |

0.31 |

|

Doctoral students |

0.04 |

|

Staff |

0.25 |

|

Internationalisation |

0.05 |

|

Research |

0.25 |

|

Research & Development |

0.10 |

|

Projects |

0.00 |

The weightings are slightly different for public university-type HEIs supervised by the Minister, with which the Minister has concluded agreements under ‘The Excellence Initiative: research higher education institution’ (Incjatywa doskonałości – uczelnia badawcza). In this case, higher weightings are assigned to Doctoral students (0.08), Research activity (0.30) and Projects (0.05), and a lower weighting to Students (0.22) and Staff (0.20).

Public non-university higher education institutions

The algorithm for the allocation of funding is based on the following 4 criteria:

-

Students: cost indices of different fields of study, student to staff ratios and the number of students enrolled on full-time programmes (with the weighting of 0.6 for second-cycle students).

-

Staff: the average number of academic staff (in full-time equivalents) multiplied by the relevant weightings depending on the position held by staff (2.5 for a Professor; 2 for a University Professor; 1.5 for an Assistant or Associate Professor).

-

Graduates: the number of graduates, and the relative graduate unemployment rates based on findings from graduate career tracking.

-

Income: the relationship between the operating revenue and various grants and subsidies received by a given HEI.

The criteria described above are used to allocate 70% of the subsidy.

Each component is assigned a weighting as presented in the table below.

|

Component |

Public non-university HEIs |

|

Students |

0.50 |

|

Staff |

0.40 |

|

Graduates |

0.05 |

|

Income |

0.05 |

Grants for HEIs to provide conditions for full participation of people with disabilities

The subsidy is distributed among individual HEIs after the total amount available is divided into grants for public and non-public HEIs. A grant is a sum of the following components:

-

Student component: based on the number of students with a disability, holding a disability certificate from the competent body, who are enrolled on programmes in each field of study at a given HEI, multiplied by the relevant weightings (3.6: deafness and hearing impairment; 2.9: blindness, visual impairment or motor dysfunction; 1.4: other types of disability).

-

Doctoral student component: based on the number of doctoral students with a disability, holding a disability certificate from the competent body, who are enrolled in doctoral schools at a given HEI, multiplied by the relevant weightings (3.6: deafness and hearing impairment; 2.9: blindness, visual impairment or motor dysfunction; 1.4: other types of disability).

-

Staff component: based on the average number of staff with a disability, holding a disability certificate from the competent body, who are employed at a given HEI (in full-time equivalents).

Grants for financial benefits for students

The subsidy is distributed among individual HEIs after a so-called supplementary amount, used, for example, for adjustment allocations, is set aside. The supplementary amount represents up to 5% of the total amount earmarked for financial benefits for students in the State budget.

The funding available after the deduction of the supplementary amount is divided into three parts in proportion to:

-

the number of students;

-

the number of students receiving a maintenance grant;

-

the number of students with a disability.

Grants for capital investment related to education / training

Pursuant to the Law on Higher Education and Science, allocations for capital investments (property / infrastructure) related to education / training take into account, in particular:

-

the importance of the planned investment for a given HEI;

-

the impact of the planned investment in terms of the safety of its users and a reduction in the operation and maintenance costs of the HEI’s facilities;

-

the possibility of attracting co-funding from other sources for the planned work or tasks.

In accordance with a Regulation based on the Law, the financial liquidity index is also taken into consideration.

The total amount allocated from the State budget for a capital investment project may not be higher than its cost estimate. The Minister transfers a grant for a capital investment project on the basis of an agreement, and the beneficiary entity is required to submit a report on the use of the grant to the Minister. The report is approved in financial terms if the grant has been spent in accordance with the legislation, the application for a grant and the agreement signed.

Public HEIs in Poland are independent in terms of financial management and manage their budgets, based on their activity and financial plans, in accordance with the Act on Public Finance (ustawa o finansach publicznych) and the Accounting Act (ustawa o rachunkowości).

As part of his / her responsibilities, the rector of a public HEI drafts an institutional strategy, manages the institution, is responsible for financial management and takes decisions in all matters concerning the institution, except those reserved by the Law on Higher Education and Science or the statutes of the HEI for its other governing bodies.

As part of the monitoring of financial performance, the council of an HEI gives its opinion on the institution’s activity and financial plan and approves the report on the implementation of the plan and the financial report.

Related legislation:

-

Act of 20 July 2018, The Law on Higher Education and Science (Ustawa z dnia 20 lipca 2018 r. - Prawo o szkolnictwie wyższym i nauce)

-

Regulation of the Minister of Science and Higher Education of 9 September 2019 on the distribution of funding for the maintenance and development of the teaching capacity and the research capacity, managed by the minister responsible for higher education and science, and funding for tasks related to the maintenance of training aircrafts and specialist training centres for aircraft staff, as subsequently amended (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 9 września 2019 r. w sprawie sposobu podziału środków finansowych na utrzymanie i rozwój potencjału dydaktycznego oraz potencjału badawczego znajdujących się w dyspozycji ministra właściwego do spraw szkolnictwa wyższego i nauki oraz na zadania związane z utrzymaniem powietrznych statków szkolnych i specjalistycznych ośrodków szkoleniowych kadr powietrznych, z późn. zm.)

-

Regulation of the Minister of Science and Higher Education of 15 September 2020 on the distribution of funding for the maintenance and development of the teaching capacity and the research capacity, managed by the minister responsible for higher education and science, and funding for tasks related to the maintenance of training aircrafts and specialist training centres for aircraft staff (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 15 września 2020 r. zmieniające rozporządzenie w sprawie sposobu podziału środków finansowych na utrzymanie i rozwój potencjału dydaktycznego oraz potencjału badawczego znajdujących się w dyspozycji ministra właściwego do spraw szkolnictwa wyższego i nauki oraz na zadania związane z utrzymaniem powietrznych statków szkolnych i specjalistycznych ośrodków szkoleniowych kadr powietrznych)

-

Regulation of the Minister of Science and Higher Education of 26 May 2023 amending the Regulation on the distribution of funding for the maintenance and development of the teaching capacity and the research capacity, managed by the minister responsible for higher education and science, and funding for tasks related to the maintenance of training aircrafts and specialist training centres for aircraft staff (Rozporządzenie Ministra Edukacji i Nauki z dnia 26 maja 2023 r. zmieniające rozporządzenie w sprawie sposobu podziału środków finansowych na utrzymanie i rozwój potencjału dydaktycznego oraz potencjału badawczego znajdujących się w dyspozycji ministra właściwego do spraw szkolnictwa wyższego i nauki oraz na zadania związane z utrzymaniem powietrznych statków szkolnych i specjalistycznych ośrodków szkoleniowych kadr powietrznych)

-

Regulation of the Minister of Science and Higher Education of 25 September 2018 on the distribution of funding to higher education institutions for financial benefits for students and for tasks related to the provision of conditions for full participation of disabled persons in the student admission process, the learning process as part of degree programmes and in doctoral schools or research activities (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 25 września 2018 r. w sprawie sposobu podziału dla uczelni środków finansowych na świadczenia dla studentów oraz na zadania związane z zapewnieniem osobom niepełnosprawnym warunków do pełnego udziału w procesie przyjmowania na studia, do szkół doktorskich, kształceniu na studiach i w szkołach doktorskich lub prowadzeniu działalności naukowej)

-

Regulation of the Minister of Science and Higher Education of 21 February 2020 amending the Regulation on the method for the distribution of funding to higher education institutions for financial benefits for students and for tasks related to the provision of conditions for full participation of disabled persons in the student admission process, the learning process as part of degree programmes and in doctoral schools or research activities (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 21 lutego 2020 r. zmieniające rozporządzenie w sprawie sposobu podziału dla uczelni środków finansowych na świadczenia dla studentów oraz na zadania związane z zapewnieniem osobom niepełnosprawnym warunków do pełnego udziału w procesie przyjmowania na studia, do szkół doktorskich, kształceniu na studiach i w szkołach doktorskich lub prowadzeniu działalności naukowej)

-

Regulation of the Minister of Science and Higher Education of 14 March 2019 on the award, accounting for, and transfer of grants for capital investment projects related to education or training and research activities (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 14 marca 2019 r. w sprawie przyznawania, rozliczania i przekazywania środków finansowych na realizację inwestycji związanych z kształceniem oraz działalnością naukową)

-

2024 Budgetary Act of 18 January 2024 (Ustawa budżetowa na rok 2024 z dnia 18 stycznia 2024 r.)

Financial autonomy and control

Colleges of social work

Colleges are subject to regulations described in the chapter Early childhood and school education funding.

Higher education institutions

Higher education institutions (HEIs) are autonomous under the terms set out in the Law on Higher Education and Science (ustawa – Prawo o szkolnictwie wyższym i nauce). Their autonomy covers, in particular, financial and resource management.

Public authorities may take decisions concerning HEIs only in cases specified in Acts of Parliament.

Use of public funds

Different types of funding have been allocated to HEIs since 2018. Since 2019, HEIs have received subsidies and grants, whereas only grants were provided earlier. Consequently, the degree of latitude in disbursing funds varies depending on the type of funding. Grant-type funding is subject to specific disbursement and accounting rules. A grant may be used to finance or co-finance specific public tasks. An HEI’s own contribution is often required to receive a grant. By contrast, it is the beneficiary entity that decides how subsidy-type funding is spent.

Public HEIs are classified as public-sector entities. Therefore, they should comply with all rules of public finance management as set out in the Act on Public Finance (ustawa o finansach publicznych) and should keep accounts in accordance with the legislation on accounting. This includes, for example, the requirement to have management control mechanisms in place, with appropriate accounting rules. If the revenues or costs included in the activity and financial plan of a public HEI exceed PLN 40 million (around MEURO 8.8), an internal audit is conducted. Moreover, since 2019, annual financial reports of public HEIs have been examined by an audit firm. An audit firm is selected by the council of an HEI.

The minister responsible for higher education supervises activities of HEIs with regard to legal compliance and proper and correct use of public funds.

The minister may request information and clarification from an HEI and the founder of an HEI, and may carry out inspections of HEIs. In the cases of breach of the law specified in the Law on Higher Education and Science, the minister may suspend student or doctoral student enrolment for the next academic year; impose a financial penalty; submit a motion to the HEI’s electoral college to dismiss the rector (or may dismiss the rector, after consultation with the General Council for Higher Education and Science and the relevant Rectors’ Conference, in the case of gross or persistent violation of the law by the rector); or submit a motion to the HEI’s senate to shorten the duration of the term of office of the council of the HEI.

The rector of each HEI provides the following documents to the planning-and-reporting database in the POL-on system (the national information system for science and higher education): the HEI’s activity and financial plans; reports on the implementation of activity and financial plans; reports on the use of subsidies and grants; and annual financial reports of the HEI examined by an audit firm. The range of data, and the procedure and timeframes for inputting, updating, storing and removing data are set out by the minister in a regulation. Where data in the POL-on system is incorrect or unreliable, or is not inputted within the timeframe set, the minister may suspend the transfer of funds as part of a subsidy until the HEI concerned eliminates the shortcomings.

Acquisition and use of private funds

HEIs may pursue business activity, separated from their core activity in organisational and financial terms, which covers the scope and forms specified in their statutes. This includes, in particular, the establishment of limited companies.

However, as other public-sector entities, HEIs may not have, acquire or purchase stocks or shares in companies or bonds issued by entities other than the State Treasury or local government units.

Public HEIs may charge tuition fees only in the cases specified by the law (see below).

Staff policy

HEIs have considerable autonomy in staff policy. This applies, especially, to the recruitment and promotion of staff and the use of disciplinary measures.

A public HEI sets out remuneration arrangements in a collective labour agreement or remuneration regulations.

However, as in the school education sector, the degree of autonomy in determining the level of salaries is limited as the national legislation lays down quite detailed remuneration arrangements. It is also worth emphasising that the national legislation applies to both academic and other staff employed in an HEI.

Pursuant to the Law on Higher Education and Science, the salary of an employee of a public HEI consists of standard and variable components. The standard components are the basic salary and the length-of-service allowance. The variable ones include: the function-related allowance and task-related allowance; pay for additional teaching hours (in addition to the compulsory teaching load) and overtime hours; the hardship allowance for work in hazardous or difficult conditions; a bonus in the case of non-academic staff; and other allowances if provided for by the collective labour agreement or remuneration regulations of an HEI.

The monthly basic salary of an academic teacher in a public HEI may not be lower than 50% of the salary of a professor. However, the basic salary for:

-

a university professor may not be lower than 83% of the salary of a professor;

-

an assistant professor may not be lower than 73% of the salary of a professor.

The minister responsible for higher education and science sets, by regulation, the level of the salary for a professor, taking into account the adequacy of the salary for the qualifications required for this position. As set in January 2024, the minimum basic monthly salary for a professor in a public HEI is PLN 9,370 (EUR 2,184.1).

The length-of-service allowance, which amounts to 1% of the basic salary, is granted for each year of employment. It is paid on a monthly basis, starting in the fourth year of employment. However, the amount may not exceed 20% of the basic salary.

The function-related allowance may be granted for managing a team composed of at least 5 members, including the one performing the management function. The allowance may not exceed 67% of the salary of a professor and depends on the number of team members and the complexity of tasks.

The task-related allowance may be granted for a temporarily extended scope of responsibilities or for additional tasks performed on a temporary basis, or as based on the nature or conditions of work. The allowance may not exceed 80% of the total amount of the basic salary and the function-related allowance.

The Law on Higher Education and Science also specifies additional remuneration components for employees of HEIs such as an anniversary awards, an additional end-of-year pay, the rector’s award, and a one-off retirement gratuity.

The rector is elected for a four-year term of office by a simple majority of members of an HEI’s electoral college. Students and doctoral students represent at least 20% of the college. The senate of an HEI gives its opinions on candidates for the rector position.

The minister responsible for higher education and science establishes the level of the basic salary and the function-related allowance for the rector of a public HEI, upon the motion from the council of an HEI. The legislation sets limits for both components of the rector’s remuneration.

Related legislation:

-

Act of 20 July 2018, The Law on Higher Education and Science (Ustawa z dnia 20 lipca 2018 r. - Prawo o szkolnictwie wyższym i nauce)

-

Regulation of the Minister of Science and Higher Education of 25 September 2018 on the minimum basic monthly salary for a professor in a public higher education institution as subsequently amended (Rozporządzenie Ministra Edukacji i Nauki z dnia 2 stycznia 2023 r. zmieniające rozporządzenie w sprawie wysokości minimalnego miesięcznego wynagrodzenia zasadniczego dla profesora w uczelni publicznej, z późn. zm.)

-

Act of 27 August 2009 on the Public Finance (Ustawa z dnia 27 sierpnia 2009 r. o finansach publicznych)

Fees within public higher education

Colleges of social work

Colleges of social work may charge entrance examination fees and tuition fees, except for full-time programmes in public colleges, unless students repeat a course due to unsatisfactory learning achievements.

Otherwise, colleges are subject to the regulations described in the chapter Early childhood and school education funding.

Higher education institutions

Public HEIs charge no tuition fees to students in full-time first-, second- and long-cycle programmes and full-time doctoral programmes.

Public HEIs may charge tuition fees only for the following education services:

-

part-time degree programmes;

-

classes / courses in a full-time degree programme retaken by a student due to unsatisfactory learning achievements;

-

degree programmes delivered in a foreign language;

-

classes / courses which are not included in the curriculum;

-

degree programmes delivered to non-Polish nationals in the Polish language.

Public HEIs may also charge fees for:

-

student admission;

-

validation of learning outcomes;

-

a student course record book, student identity card and duplicates of these documents issued to a student;

-

an additional certified copy of a higher education diploma or of a Diploma Supplement issued in a foreign language;

-

a duplicate of the higher education diploma and the Diploma Supplement;

-

accommodation in student dormitories and meals in student canteens.

Moreover, public HEIs may charge tuition fees for non-degree postgraduate programmes, specialist programmes and other types of programmes or courses. Finally, fees may be charged for the endorsement of documents relating to academic progress during non-degree postgraduate and specialist studies or to the completion of non-degree postgraduate and specialist programmes to be used in legal transactions with other countries.

The minister responsible for higher education and science sets the level of some fees in a Regulation:

-

PLN 4 (EUR 0.9) for a student academic record book;

-

PLN 20 (EUR 4.7) for a duplicate of a higher education diploma or a Diploma Supplement, or an additional certified copy of these documents issued in a foreign language;

-

PLN 22 (EUR 5.1) for a student identity card;

-

PLN 26 (EUR 6.1) for the endorsement of documents to be used in legal transactions with other countries.

The Regulation also sets the level of a registration / admission fee. Currently, it is PLN 85 (EUR 19.8), but the fee is higher in some fields of study:

-

PLN 150 (EUR 35) for applicants in the fields of study where artistic aptitude tests should be conducted as part of the admission process;

-

PLN 100 (EUR 23.3) for applicants in the fields of study where an entrance exam, including a physical fitness test, should be conducted as part of the admission process.

The legislation also states that tuition fees for education services may not exceed the costs incurred by an HEI to the extent necessary to establish and deliver a programme, including the costs of preparing and implementing an institutional development strategy.

The level of fees for the validation of learning outcomes may not exceed the costs of delivering such services by more than 20%. However, HEIs do not charge fees for activities related to the verification of learning outcomes specified in the curriculum, nor for issuing documents relating to academic progress during studies other than those listed above.

HEIs determine the amount of fees charged to students and the conditions for exemption from fees before the commencement of the student admission process. The student self-government body should be consulted about the level of fees. Until students enrolled in a given academic year graduate, an HEI may not raise the fees or introduce new ones. This does not apply to fees for courses / classes which are not included in the curriculum, accommodation in student dormitories and meals in student canteens. HEIs should immediately publish information on fees in the Public Information Bulletin and on their websites.

Related legislation:

-

Act of 14 December 2018, The Law on School Education (Ustawa z dnia 14 grudnia 2016 r. - Prawo oświatowe)

-

Act of 20 July 2018, The Law on Higher Education and Science (Ustawa z dnia 20 lipca 2018 r. - Prawo o szkolnictwie wyższym i nauce)

-

Regulation of the Minister of Science and Higher Education of 27 September 2018 on degree programmes (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 27 września 2018 r. w sprawie studiów)

Financial support for learners' families

There are no separate financial support mechanisms for students' families.

Financial support is available, in specific cases discussed in the next section, only to students and conditional upon the financial situation of the family.

Where they meet certain criteria, families of students can benefit from support in the form of family benefits, the Large Family Card and a family tax benefit described earlier.

Students (enrolled on first-, second- and long-cycle programmes) and doctoral students are entitled to free medical care at public healthcare facilities. HEIs pay health insurance contributions for their students. The validity of the entitlement expires 4 months after graduation or the striking of a student from the register of students.

Students and doctoral students may apply for accommodation in a dormitory and for meals in a student canteen of their HEI, and for accommodation for their spouse and children in a dormitory of their HEI.

Additionally, students are entitled to a 50% reduction in urban public transport fares. Entitlements to reduced fares for public railway and bus transport are laid down in separate legislation. Local government units may decide to reduce fares for urban public transport for doctoral students.

Related legislation:

-

Act of 27 August 2004 on Publicly Funded Healthcare Services (Ustawa z dnia 27 sierpnia 2004 r. o świadczeniach opieki zdrowotnej finansowanych ze środków publicznych)

-

Act of 20 July 2018, The law on Higher Education and Science (Ustawa z dnia 20 lipca 2018 r. - Prawo o szkolnictwie wyższym i nauce)

Financial support for learners

Colleges of social work

College students are covered by the legislation on financial support from the State budget or local government budgets for learners in schools and other educational institutions, as described in the chapter Early childhood and school education funding.

Higher education institutions

Students in first-, second- and long-cycle programmes and doctoral students receive non-refundable and refundable financial support.

Main types of support for students:

|

Type of support |

Form of support |

|

Non-refundable support |

Maintenance grant |

|

Grant for disabled persons |

|

|

Rector’s scholarship |

|

|

Minister’s scholarship |

|

|

Aid payment |

|

|

Refundable support |

Student credits |

Source: Author’s elaboration.

An HEI grants benefits specified in the Law on Higher Education and Science (ustawa – Prawo o szkolnictwie wyższym i nauce) but may also establish its own fund to award scholarships for learning achievements. Rules for awarding such scholarships are agreed with the student or doctoral student self-government body. Funding comes from payments made by natural and legal persons, and a write-off charged to expenditure on teaching and research activities which may not exceed 20% of the forecast net profit and may not result in a loss in a given financial year.

Students may also receive financial support from local government bodies. Additionally, natural persons and legal persons other than State or local government bodies can award scholarships for academic and sporting achievements. At the request of the person awarding a scholarship, the minister responsible for higher education and science approves the rules for awarding scholarships.

Student self-government (samorząd studencki) conducts activities related to student matters, including student welfare and cultural activities. The student self-government body takes decisions on the distribution of funds allocated for student matters by the governing bodies of an HEI. It submits to the governing bodies of the HEI a report on the distribution of funds at least once in an academic year and publishes it in the Public Information Bulletin and on the website of the HEI. An HEI provides conditions necessary for the operation of the student self-government, including infrastructure and funding which are managed by the student self-government.

Students have the right to associate in student organisations within an HEI and, in particular, in research interest groups, artistic groups and sports clubs. An HEI may allocate funds for activities of student organisations and associations operating within the institution which bring together only students or students, doctoral students and staff. The organisations concerned submit a report on the use of funds received in a given academic year.

Non-refundable support

Non-refundable benefits, except for the minister’s scholarship, are granted from the grants fund at the request of the student.

At the request of the student self-government body, decisions on grants, scholarships and aid payments are taken by an institutional grants committee where the majority of members are students. However, the rector of an HEI overturns decisions of the committee which are in contravention of the law.

Pursuant to the Law on Higher Education and Science, the amount earmarked for the rector’s scholarships may represent up to 60% of the total amount allocated for the rector’s scholarships, maintenance grants and aid payments.

The total monthly amount of a maintenance grant and of the rector`s scholarship may not exceed 38% of the salary for a professor.

In consultation with the student self-government body, the rector adopts detailed regulations for the calculation, award and payment of student financial support benefits.

Grants and scholarships are awarded for a semester or academic year.

A student enrolled on programmes in several fields of study may receive a grant, scholarship and aid payment only in one field, indicated by him / her. Such financial benefits are available to students enrolled on first, second- and long-cycle programmes, but for a maximum period of 6 years. Students holding a Master’s (magister) or Bachelor’s (licencjat or inżynier) degree (or an equivalent degree) are not eligible to receive such benefits if they enrol on an additional first-cycle / Bachelor’s degree programme.

Maintenance grants

Maintenance grants are available to students in a difficult financial situation. As from the academic year 2024/2025, the income threshold as the criterion for awarding maintenance grants will be determined in relation to the minimum wage: as 45% of the minimum wage set on 1 January of the previous year. Thus, in 2024, the threshold is PLN 1,570.50 (EUR 366.1).

Grants for disabled persons

Such grants may be awarded to students with a disability confirmed by a certificate from the competent body.

Rector’s scholarships

A scholarship may be awarded to a student with outstanding learning achievements, research or artistic achievements, or sporting achievements in national- or international-level contests.

The rector’s scholarships are awarded to a maximum of 10% of students in a given field of study. If the number of students in a field of study is smaller than 10, the scholarship can be awarded to 1 student.

Additionally, such a scholarship is awarded to a student enrolled in the first year of study who is:

-

the winner of an international-level knowledge competition;

-

at least a finalist in a national-level knowledge competition;

-

a medal winner in a sporting contest at least at the level of national championship in a given sport.

Minister’s scholarships

A student may receive the Minister's scholarship for significant academic, artistic or sporting achievements.

The minister responsible for higher education and science awards scholarships once a year at the request of the rector.

The minister awarded 386 scholarships in 2024, and each scholarship amounted to PLN 17,000 (EUR 3,962.7).

Aid payment

An aid payment is available to students who are temporarily in a difficult financial situation.

Students may receive such a payment twice in an academic year.

Refundable financial support

Refundable financial support is provided in the form of student credits.

An application for a credit can be submitted by a student, doctoral student or a person applying for admission to a first-, second- or long-cycle programme or a doctoral school. However, a student credit may be granted to students who have not reached the age of 30, with a low per-capita income in the family. The minister responsible for higher education publishes annually the maximum amount of monthly per-capita income in the family that entitles the student to obtain a student credit. In the academic year 2023/2024, the net amount was PLN 3,500 (EUR 815.85).

A student does not receive a student credit if the outcome of the collateral assessment for credit repayment conducted by a credit institution is negative for each monthly tranche of the credit.

Student credits are granted for the duration of studies, and the total period may not exceed 6 years. A credit is granted only once at a given level of study. If students are enrolled on a second- or long-cycle programme within 2 years after completion of a first-cycle programme, they may continue to use the credit granted without submitting a new credit application. However, they may use a student credit for a maximum total period of 6 years.

Student credits are paid in monthly tranches for up to 10 months in an academic year, excluding periods of leave granted in accordance with the study regulations. The amount of a monthly credit tranche is PLN 400 (EUR 93.2), PLN 600 (EUR 139.9), PLN 800 (186.5) or PLN 1,000 (EUR 233.1). The borrower may apply for a different monthly tranche to be paid.

Since 18 December 2021, the interest rate for student credits has been set as a half of the rate that is a sum of the bank's margin and 1.2 of the rediscount rate of the National Bank of Poland.

At the request of the borrower, a monthly repayment may be reduced to 20% of his / her monthly income.

The repayment of a student credit:

-

starts 2 years after graduation, unless the borrower has applied for an earlier starting date to be set;

-

is spread over a period which is twice as long as the period for which the credit was granted, unless the borrower has applied for a repayment period to be shortened.

At the request of the borrower, the repayment of a student credit, together with interest charges, may be suspended for a period of up to 12 months if the borrower is in a difficult financial situation. This can be due, in particular, to the loss of a stable source of income by the borrower or his / her spouse or an unforeseen event which results in temporary inability to repay the credit. Such circumstances include an illness of the borrower or a member of his / her family, the need to take care of a sick member of the family, or damage caused by a fire, natural disaster or another catastrophe.

At the request of the borrower, a student credit can be written off:

-

a 50% write-off: if the borrower has completed a first-, second- or long-cycle programme or training in a doctoral school among the top 1% group of graduates in a given academic year;

-

a 35% write-off: if the borrower has completed a first-, second- or long-cycle programme or training in a doctoral school among the top 1.01 to 5% group of graduates in a given academic year;

-

a 20% write-off: if the borrower has completed a first-, second- or long-cycle programme or training in a doctoral school among the top 5.01 to 10% group of graduates in a given academic year.

A student credit can also be:

-

partially written off if the borrower is in a particularly difficult situation;

-

fully written off if the borrower has permanently lost the ability to repay the credit.

Student credits are funded from the financial resources of commercial banks, whereas the State budget contributes towards the interest charges.

Where student credits are partially or fully written off, the write-off amount is also paid by the State budget.

Related legislation:

-

Act of 20 July 2018, The Law on Higher Education and Science (Ustawa z dnia 20 lipca 2018 r. - Prawo o szkolnictwie wyższym i nauce)

-

Regulation of the Minister of Science and Higher Education of 1 April 2019 on scholarships awarded by the minister responsible for higher education and science to students and outstanding young scholars (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 1 kwietnia 2019 r. w sprawie stypendiów ministra właściwego do spraw szkolnictwa wyższego i nauki dla studentów i wybitnych młodych naukowców)

-

Regulation of the Minister of Science and Higher Education of 20 December 2018 on student credits (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 20 grudnia 2018 r. w sprawie kredytów studenckich)

Private education

Colleges of social work

Colleges are subject to the regulations described in the chapter Early childhood and school education funding.

Higher education institutions

Non-public higher education institutions (HEIs) receive grants for tasks related to financial support for students, and tasks related to the provision of conditions for full participation of persons with disabilities in the learning process and research activity.

Non-public HEIs may also receive a subsidy for the maintenance and development of their research capacities. The algorithm for the distribution of the subsidy among non-public university-type HEIs is based on 3 criteria:

-

Doctoral students: cost indices and the number of doctoral students, excluding those who are employed as academic staff under an employment contract (with non-Polish nationals assigned the weighting of 1.5);

-

Research activity: the number of disciplines in which a given HEI has been awarded a research category higher than C (with the weightings depending on the category and ranging from 0.75 for Category B to 1.75 for Category A+); cost indices of the disciplines concerned; and the number of staff (in full-time equivalents) conducting research activities in the disciplines concerned.

-

Staff: the number of staff holding the professorial title (profesor), a post-doctoral degree (doktor habilitowany) or a doctoral degree (doktor), with relevant weightings, and the number of non-research staff participating in research activity.

Each criterion is assigned a weighting: 0.30 for the Research activity criterion; 0.70 for the Doctoral Students criterion; and 0.0 for the Staff criterion in 2024.

The two criteria discussed above are used to distribute 75% of the subsidy. The remaining 25% is based on the so-called transfer rate constant discussed in the previous chapter.

Moreover, the algorithm-based subsidy distributed among non-public university-type HEIs may not be lower than 95% and higher than 110% of the subsidy granted in the previous year. However, these limitations do not apply to non-public university-type HEIs which hold research category C in at least one discipline of science or fine arts.

Non-public HEIs keep funds received as part of State-budget grants and subsidies in a separate bank account.

Non-public HEIs manage their funds independently, based on an activity and financial plan, in accordance with the legislation on accounting. In managing State-budget funds, non-public HEIs are subject to the legislation on public finance.

Students in non-public HEIs may apply for financial support based on the same regulations as students in public HEIs.

Like public HEIs, before starting the student admission process, non-public HEIs determine the types and levels of fees charged to students. Until students enrolled in a given academic year graduate, HEIs may not raise fees or introduce new ones.

Rules for charging fees and the amount of fees in a non-public HEI are set by the body identified in its statutes. However, fees for education services may not exceed the costs necessary to establish and deliver a programme, and the costs of devising and implementing the institution’s strategy.

A non-public HEI should obtain a permit from the minister responsible for higher education to establish degree programmes and should be entered into the Register of Non-Public HEIs.

Related legislation:

-

Act of 20 July 2018, The Law on Higher Education and Science (Ustawa z dnia 20 lipca 2018 r. - Prawo o szkolnictwie wyższym i nauce)

-

Regulation of the Minister of Science and Higher Education of 9 September 2019 on the distribution of funding for the maintenance and development of the teaching capacity and the research capacity, managed by the minister responsible for higher education and science, and funding for tasks related to the maintenance of training aircrafts and specialist training centres for aircraft staff (Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 9 września 2019 r. w sprawie sposobu podziału środków finansowych na utrzymanie i rozwój potencjału dydaktycznego oraz potencjału badawczego znajdujących się w dyspozycji ministra właściwego do spraw szkolnictwa wyższego i nauki oraz na zadania związane z utrzymaniem powietrznych statków szkolnych i specjalistycznych ośrodków szkoleniowych kadr powietrznych)